How To Get A Small Business Grant

Why should an entrepreneur know how to get a small business grant? Apply successfully, and you get free money. If your startup is going to thrive, it needs cash.

One of the main reasons for solopreneur failure is lack of funds. A sure-fire way to avoid this is to secure ample funding of course. The right investment can be the difference between making $100K a year or going under.

Grants are the best of both. They provide owners with funding for a new venture that does not require repayment.

1. Define company plan

If a corporation or non-profit organization is going to give any money away, they want to ensure the recipient is the most deserving. They will look at several factors, but one will be your business plan.

A great idea for overall achievement regardless of you grant status. It will spell out for you and any investor, how you turn your small venture into a sustainable enterprise.

Before approval, they will analyze your strategy. And they can get a clear look with your business plan. What do you hope to achieve in year #1 or year #5, and beyond? Are your goals attainable? Is your team in place and ready? What have you achieved those far that is noteworthy?

Your plan will answer all these questions concisely. To be awarded any backing will absolutely require it.

2. Get legal

Any credible option will require your operation to be legitimate. What does this mean? It’s simple, you must be incorporated, possess any required licenses, have an EIN number, Dun & Bradstreet number, etc.

Besides protecting themselves from potential lawsuits if you are found to be lacking any of these, those that do are more inclined to be successful. Makes sense that if your company already follows the rules that you will be a good steward of the award as well.

You cannot escape the responsibility of tomorrow by evading it today. Abraham Lincoln

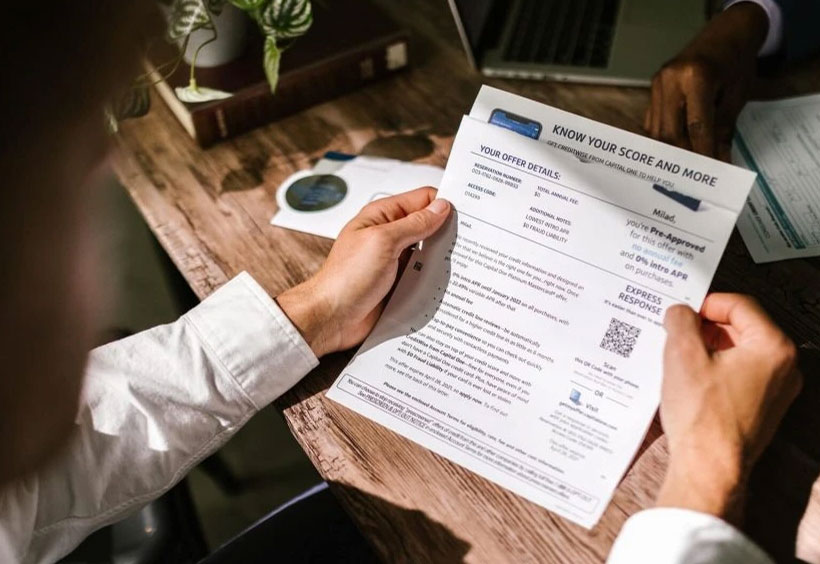

3. Conduct research

Check what’s available on a national, state, and local level. The US Chamber of Commerce for example list a huge number of opportunities on its site. You will find endowments for minority-owned firms, woman-owned firms, military vets, and more.

SBA grants are also researched, but don’t provide as much, in the way of results, as the U.S. Chamber above and Grants.gov. These two sources provide a mountain of information to absorb.

States like Georgia and the Georgia Department of Economic Development are a terrific source for yet more money if you live in the Southeast. But The Peach State is just an example. A quick search will uncover many options in your home state.

And remember it doesn’t stop at the federal and state levels. Look at cities in your geographical area as well. Many empowerment zone programs exist throughout the country.

In addition to these options, many corporations have programs too. Titans like Amazon, Walmart, and FedEx donate tens of thousands each year to companies that are positioned to make a difference. So, get started reviewing which ones you qualify for.

4. Watch out for scams

Scam artist know you are looking to get funding. So, be aware of any site asking for money in exchange for an approval. Legitimate sources are free and will never ask for any payment. And as covered just above, many of these sources are government agencies.

If it sounds too good to be true it is. Run, don’t walk away.

5. Become a writing expert

The last step to learning how to get free cash is to become an excellent writer. This is simply your ability to give any review board what they request. Your writing must be spot on and clear.

First, you’ll want to confirm that you’re a good match. So, resist the temptation to just apply haphazardly. Second, follow the instructions closely. You don’t want to disqualify your company on a mere technicality. Next, you’ll want to clearly state what the purpose of the money will be.

Grant writing is not rocket science, but there are dos and don’ts. Unless you have previous experience, expect some ramp up time to perfect it. You’ll know you’ve got it when your firm gets that congratulatory notice.