Startup Business Loans With Bad Credit

Every budding entrepreneur knows that to jumpstart their dream, they need a decent amount of capital. However, having a bad credit score can often throw a wrench into these plans. If you’re exploring ways to obtain startup business loans with bad credit, this guide can light the path for you.

The Foundation: Understand Your Credit

Your credit score acts as a financial reflection of your reliability. A poor credit score might imply financial instability, while a high one can demonstrate financial discipline. Before diving into the application process for startup business loans with bad credit, it’s crucial to get acquainted with your own score.

- Deciphering Your Credit Score: Banks and financial institutions will begin their assessment with your FICO score. This score offers a snapshot of your financial history and gives lenders an idea of your repayment capabilities, especially in cases where there’s no collateral involved. If you’re thinking long-term, start working on enhancing your credit score today, because improving it can significantly boost your chances of loan approval in the future.

Crafting a Solid Business Plan

The clearer your vision, the higher your chances of securing a loan, even with a less-than-stellar credit score.

- Why Precision Matters: Specify the exact amount you aim to borrow. Vague figures can be off-putting for lenders. Being precise about your needs and how the funds will be utilized can instill confidence in potential lenders.

- The 5 W’s: Ensure your business plan thoroughly answers the Who, What, When, Where, and Why. This will not only provide clarity to the lenders but also showcases the depth of your planning.

- Highlighting Returns on Investment: For instance, if you plan to buy new equipment to expand your moving company’s services, demonstrate how this will amplify revenue, helping ensure lenders of your repayment ability.

Tactics to Navigate Startup Business Loans With Bad Credit

- Consider Waiting: If it’s not pressing, you might consider delaying your loan application. With time, you can correct errors on your credit report or pay off existing debts. Both actions can lead to a significant improvement in your credit score.

- Assess the Costs: Understand the interest rates and additional charges associated with your loan. Remember, bad credit often translates to higher interest rates. Ensure you’re well-aware of the long-term implications and costs of any loan you’re considering.

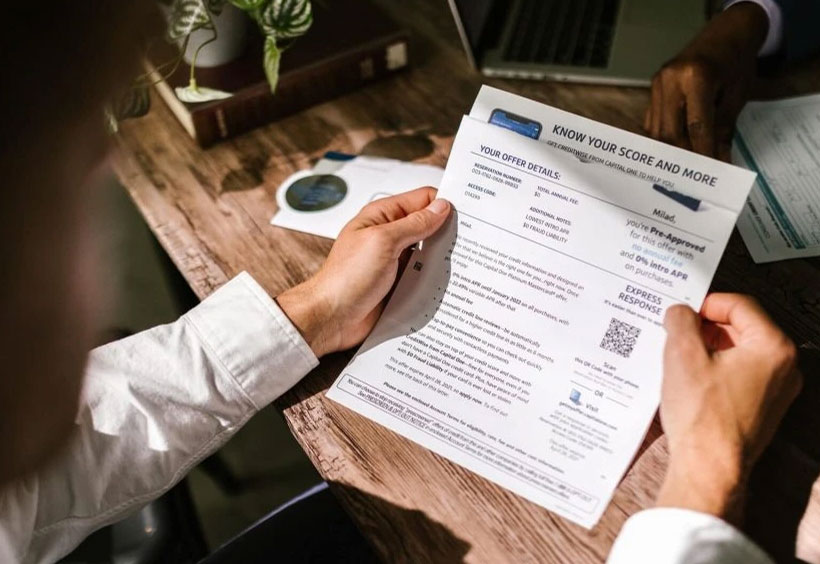

- Documentation is Key: Compile all necessary documents, such as tax returns, financial statements, lease copies, and articles of incorporation. A complete, organized application can significantly speed up the approval process.

- Seek Federal Support: The Small Business Administration (SBA) can be a beacon for those with bad credit. While the SBA doesn’t directly lend money, they guarantee loans made by partner banks, ensuring lenders that they will get their money back, even if the borrower defaults.

In Conclusion

Navigating the complex world of startup business loans with bad credit can be daunting, but it’s far from impossible. By strategically approaching the process and showcasing the potential of your business venture, you can secure the necessary funds to turn your entrepreneurial dreams into reality.