How To Get An EIN Number

Why should you apply for an Employer Identification Number (EIN)? Great question, and the answer is simple: accounting. When a person starts a business they will generate liabilities and, hopefully, income.

And although your individual efforts quite possibly are responsible for generating that cash flow, you as an individual are not responsible for its tax liability. Your company is.

The easiest way for you, and the IRS, to separate these expenditures is to get a federal EIN. These legal IDs are sometimes referred to as FEIN (Federal Employer Identification Number) or TIN (Taxpayer Identification Number) numbers. Different names, but they are the same.

The taxman defines the name variations on their site irs.gov. The Small Business Administration (SBA) simplifies the perceived differences between the two further. “Your Employer Identification Number is your federal tax ID.”

Okay, now that we know what it is, how and why should you get one? Below are seven great reasons why you should complete an application today.

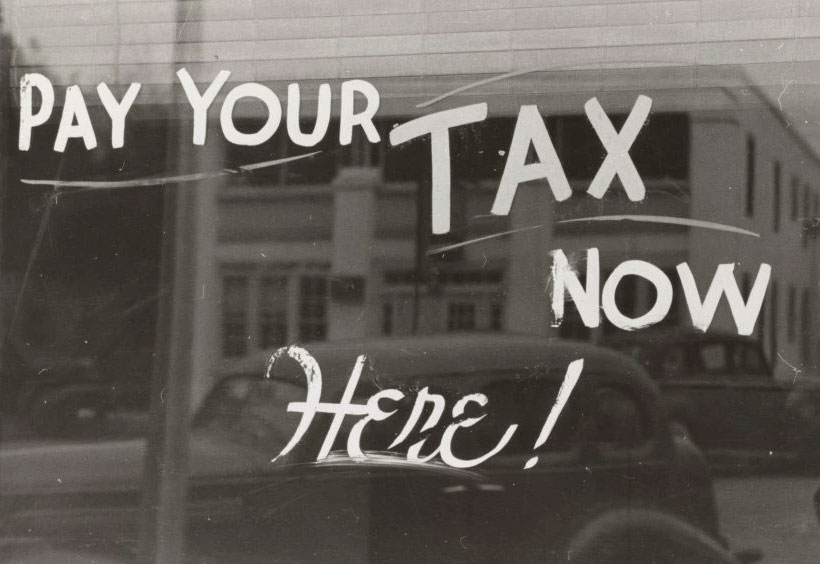

1. IRS filings

Can’t wait to take on this administrative task, right? But there is good news, following these steps will make your financial life a heck of lot easier. Plus timely filings keep self-employed folks out of trouble.

Even if your a solopreneur, securing yours will help separate what expenditures belong where. Accurate records simplify it all, and your unique helps you achieve that.

2. Opening bank accounts

Register for gov’t number online, and you will have one of the necessary steps covered to open an account for your biz.

An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity.

The benefits of a commercial account include certain deductions, protecting your personal assets, and separating personal and business transactions. And filing for your TIN gets that ball rolling.

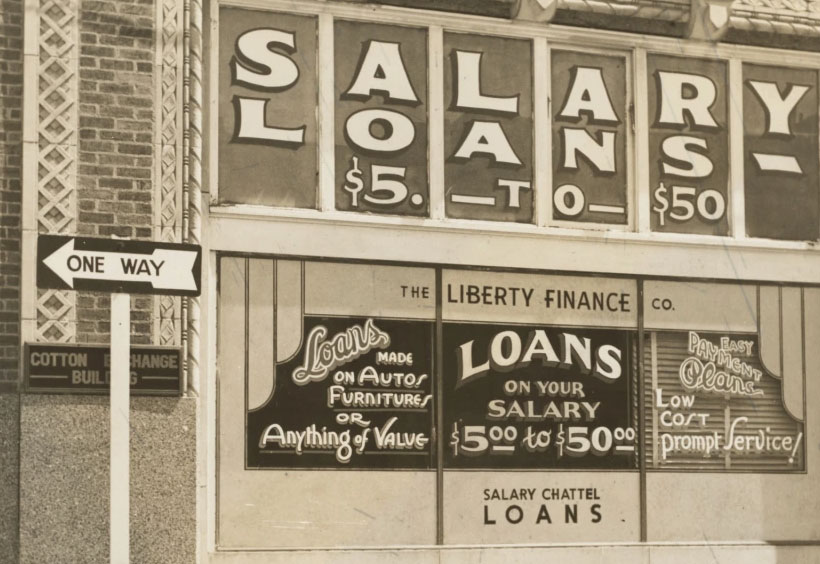

3. Get a line of credit

A quick search of your bank’s website for loan or credit requirements will uncover the need for a tax id. Everything must be tracked, even a loan made to you by your bank.

Consequently, your financial institution will need one on any application you submit. So, get this taken care of before you ask your bank for a loan.

4. Payroll records

Staff payroll is another reason your firm needs one these federal digits. Your unique identifier will help you track employee payments. And it is necessary if you run a startup from home or you’re buying a franchise.

Apply for tax id before processing any employee payroll and to keep perfect records. Taking care of the minor details like this can also help you to avoid business failure.

5. Entrepreneurial legitimacy

As soon as you get one you will feel legitimate. Your company will be taking the necessary steps to operate above board, and you will transform it from a side hustle into a real enterprise.

Your new filing will also limit the possibility of identity theft, expedite license approvals, and build trust with vendors and customers alike.

6. Prompt turnaround

Not only can you apply at no charge, but you will get the green light on yours quickly. The entire process can be completed in just a few minutes.

No super long and complicated forms to fill out. Just an easy to follow and intuitive login procedure that can literally be completed in minutes.

7. The app free

Some folks try to profit from this free government service. It’s unfortunate that some hard working entrepreneurs out there will be taken advantage of. But not you!

Anyone that attempts to charge for an EIN should be ashamed. Would you pay the U.S. government to get a social security number? Of course not.