How To Get A Small Business Loan

Navigating the financial landscape to secure a small business loan can seem daunting. However, understanding the process and what lenders look for can increase your chances of approval. Whether you’re an established business looking to scale or a startup seeking initial capital, this guide covers all you need to know about how to get a small business loan.

Table of Contents

- Timing Your Loan Application

- Evaluating Your Credit

- Understanding Loan Requirements

- Defining Your Loan Purpose

- Organizing Essential Documents

- Types of Loans to Consider

- Exploring Collateral Options

Timing Your Loan Application

When Do You Need The Funds?

Timing is key. If your business is seasonal, aim to secure funding when you’re doing well, not during a lull. For startups planning to launch soon, assessing your funding options well in advance is wise. Investors want their support to enhance your success, not be a lifeline you’re dependent on.

Evaluating Your Credit

How Strong is Your Credit?

Your credit profile plays a significant role in loan approval. Some lenders specialize in funding businesses with less-than-perfect credit, but remember, better credit usually means better loan terms. Use free resources to check your credit and dispute any inaccuracies on your Transunion, Equifax, or Experian reports.

Understanding Loan Requirements

Know the Lender’s Criteria

It’s essential to understand your lender’s requirements to improve your chances of approval. Go through their qualifications listed on their website to gauge where you stand. This doesn’t mean you’re out of luck if you fall short; other lending options may be more suited to your needs.

Defining Your Loan Purpose

How Will The Funds Be Utilized?

Lenders want to know the specifics of how you plan to use the loan. Whether it’s for inventory, payroll, or other operational costs, a clear plan improves your chances. Discuss your professional experience and current metrics such as sales figures and future projections to strengthen your application.

Organizing Essential Documents

Documents You’ll Need

A solid paperwork trail is essential for loan approval. Prepare to present:

- Financial statements

- Tax returns for the last three years

- Business license and EIN number

- Articles of Incorporation

- Customer contracts

- Lease agreements

For startups, an operation strategy and updated resume can supplement the absence of some of these documents.

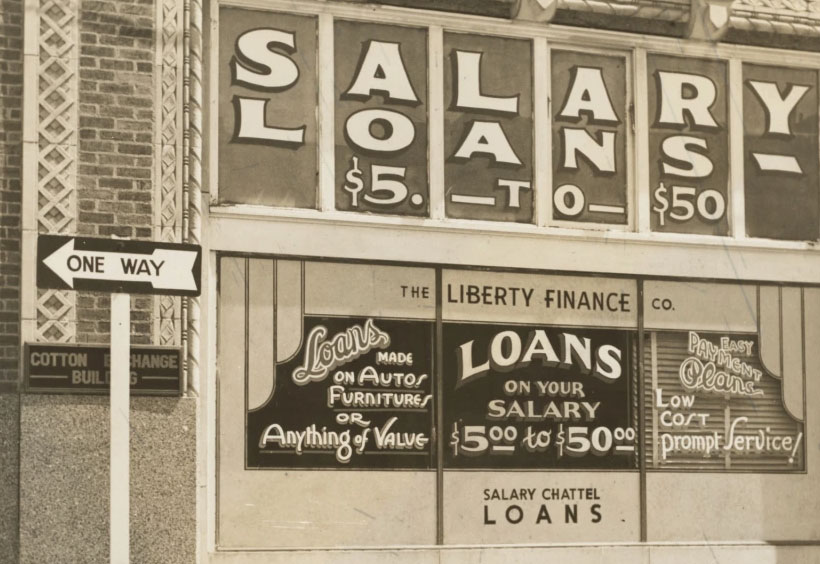

Types of Loans to Consider

Loan Options to Explore

Various loan types can serve your needs, depending on your business stage and goals. These include Peer-to-Peer lending, working capital loans, and Merchant Cash Advances. Each comes with its own terms, so research thoroughly to find the best match.

Exploring Collateral Options

Do You Have Assets to Secure the Loan?

If other options don’t appeal to you, consider using collateral like real estate or equipment. For example, if you’re expanding your moving company, you could use your existing truck as collateral to finance a new one.

The Bottom Line

Securing a small business loan is a journey that requires preparation and a clear understanding of your needs and capabilities. Managing your assets effectively will not only enhance your loan approval odds but also contribute to your business’s long-term success.