How to Incorporate in California: A Definitive Guide

With its diverse economy, innovative spirit, and vast market opportunities, California remains a prime location for entrepreneurs looking to solidify their business presence. If you’re considering turning your dream project into a formal business entity in the Golden State, you’ll find this guide on how to incorporate in California both timely and essential.

Understanding Incorporation: The Basics

Incorporation is the process of legally defining your business as a corporate entity. In essence, this means your business becomes distinct from you, obtaining its own rights, privileges, and liabilities. Incorporating provides a business with a protective shield, primarily guarding personal assets against business liabilities.

Steps on How to Incorporate in California

- Choose a Business Name: Your corporate name should be distinguishable from existing entities and must include “Corporation”, “Incorporated”, “Limited”, or abbreviations thereof.

- Designate an Agent for Service of Process: This is someone (either an individual or a business entity) who will receive legal documents on your corporation’s behalf.

- File the Articles of Incorporation: Submit the Articles of Incorporation with the California Secretary of State’s office. As of 2024, this can be done online, by mail, or in person. There’s a filing fee associated with this process.

- Create Corporate Bylaws: Although not submitted to the state, bylaws are crucial as they outline the structure and operations of your corporation.

- Hold an Initial Board of Directors Meeting: Here, you’ll address essential matters like the approval of bylaws, issuance of stock, and the appointment of corporate officers.

- Get an Employer Identification Number (EIN): This is a unique number assigned by the IRS, often referred to as the business’s tax ID.

- Register for State Taxes: Depending on your business type and location, you may need to register with the California Department of Tax and Fee Administration (CDTFA) for tax purposes.

- Obtain Necessary Business Licenses and Permits: These vary based on locality and the nature of your business.

- Comply with Annual Requirements: This includes the annual Statement of Information filing and maintaining good standing with the state.

Pros and Cons of Incorporating in California

Pros:

- Liability Protection: Incorporating separates personal assets from business liabilities.

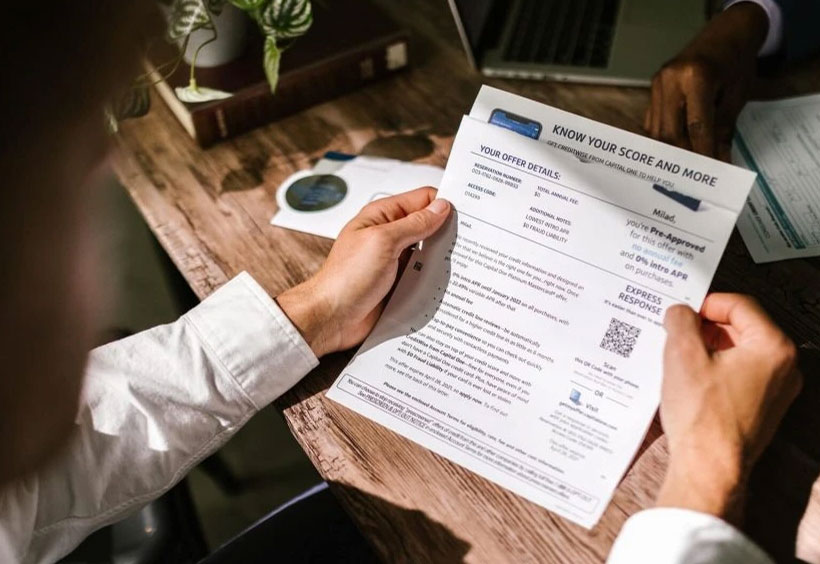

- Tax Advantages: Certain tax benefits are exclusive to corporations, including business expense deductions.

- Increased Credibility: Having “Inc.” or “Corp.” in your business name can boost consumer trust.

- Access to Capital: Corporations can raise capital by issuing shares of stock.

Cons:

- Costly and Time-Consuming: The incorporation process can be bureaucratic and might entail higher initial costs.

- Double Taxation: C-corporations face double taxation, first at the corporate level and then at the individual shareholder level.

- Regulatory Scrutiny: Corporations are often subject to rigorous regulations and mandatory reporting.

Best Cities in California to Start a Business

- San Francisco: The tech mecca offers unparalleled opportunities for tech-driven businesses.

- Los Angeles: Perfect for entertainment, fashion, and digital startups.

- San Diego: A biotech hub with a growing focus on healthcare and life sciences.

- San Jose: The heart of Silicon Valley, ideal for tech and IT-focused businesses.

- Irvine: Known for its supportive local government and concentration of tech startups.

- Sacramento: The state’s capital provides opportunities for businesses in the service and agricultural sectors.

- Oakland: Rapidly growing with diverse sectors including healthcare, food, and tech.

Conclusion

Understanding how to incorporate in California is pivotal for entrepreneurs eyeing long-term success in the state. While the process might seem overwhelming at first, the benefits of incorporating—like personal asset protection and potential tax advantages—can significantly outweigh the initial efforts. With its innovative spirit and economic vibrancy, California presents a wealth of opportunities, making the journey of incorporation well worth the investment.